The net present value and discounted cash flow (DCF) analyses can be used together to help you make an informed decision. But they’re not the same. The discounted cash flow analysis helps you determine how much projected cash flows are worth in today’s time. The Net Present Value tells you the net return on your investment, after accounting for startup costs.

Both calculations examine your small business’s cash flows, or how much money is taken in and spent.

What Is Net Present Value?

Net present value calculates your return on investment by looking at how much money generated in the future is worth today, and whether or not those expected cash flows are more or less than your initial investment.

The formula takes the total cash inflows in the future and discounts it by a certain rate to find the present value. You then subtract the initial cost of the investment from the total cash inflows. If the result is greater than zero, then the investment is expected to make a return. If the result is less than zero, then the investment is expected to result in a net loss.

How Do You Perform a Net Present Value Calculation?

To find the net present value, you’ll need to know three things:

- The amount of the initial investment

- The discount rate, or the desired rate of return

- The period of time being analyzed

There are two formulas to calculate the net present value. Knowing which one to use depends on what kind of information you have.

With Different Cash Flows Each Time Period

If the project or asset you’re looking at is estimated to generate different cash flows for each time period, you’ll use this formula:

(C for Period 1 / (1+r)1) + (C for Period 2 / (1+r)2) + … (C for given time period t / (1+r)t) – C0

In the formula above,

- C represents the cash flow that the asset is projected to generate in each time period.

- R represents the discount rate that will be used to find the present value of the future cash flows. The discount rate is the desired rate of return you could get for your money if it were used for a different investment with a similar risk level. The rate could be the interest rate, bond rate, or any other percentage you choose.

- C0 represents the initial investment—or how much money you’ll be spending to make the initial investment.

With the Same Cash Flows Each Time Period

If the project or asset you’re looking at is estimated to generate the same amount of cash flow for each time period, you’ll use this formula:

R x ((1-(1+i)-n)/i) – Initial Investment

In the formula above:

- R represents the net cash inflow for each time period.

- i represents the required rate of return, or discount rate.

- n represents the time period you’re using to value the project or asset.

Regardless of which formula you’re using, if the resulting net present value is a positive number (greater than 0), then the investment is considered valuable, and a good investment. If the resulting net present value is a negative number, then it’s considered to be a bad investment.

An Example of the Net Present Value Calculation

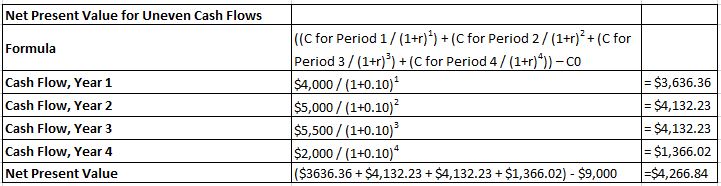

Say you are considering purchasing a piece of equipment for your business that costs $9,000. You are expecting the piece of equipment to help generate $4,000 at the end of the first year, $5,000 at the end of the second year, $5,500 at the end of the third year, and $2,000 at the end of the fourth year. The discount rate you’re applying is 10%.

Because each year’s projected cash flow is different, you’ll use the first formula to find the net present value. Here’s what it looks like:

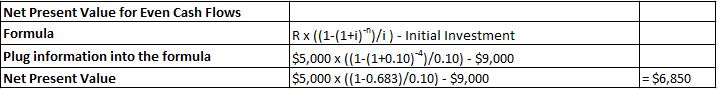

If the cash flows were projected to be the same over the four years, you would use the other formula. Here’s what the formula would look like if the equipment were estimated to make your business an extra $5,000 a year for four years. With a net present value of $4,266.84, investing $9,000 to purchase the piece of equipment could be a valuable investment. The project is estimated to generate $16,500 over the next four years. The present value of the projected cash flows is $13,266.84. This means the money the project is generating in the future is greater than the initial investment of $9,000. Therefore, the project has the potential to give you a positive return on investment.

In both examples, if the net present value were negative, it would mean you could expect to lose money over the course of the project. In other words, if the net present value is a negative number, you wouldn’t expect to see a positive return on your investment and you’d likely experience a loss after making the investment. The net present value of $6,850 indicates that the project could be a worthy investment. When you complete the formula, you’ll see the $20,000 generated over the next four years is worth about $15,850 today. The $15,850 is greater than the cost of the investment ($9,000), which means you can expect to make a profit and generate growth.

What Are the Limitations of Net Present Value?

A big limitation to net present value is its reliance on assumptions and estimations of future cash flows. This means if you’re overly optimistic about how much money will be generated in the future, you can get an inaccurate net present value. This can cause you to make the wrong decision on whether or not to make the investment.

The net present value calculation also won’t tell you how long an asset will generate a positive net present value, or if it ever will. Let’s say you’re looking at six years’ worth of projected cash flows for an asset and the net present value is negative. The formula doesn’t tell you if the asset will start generating a net present value at seven years, 10 years, or ever.

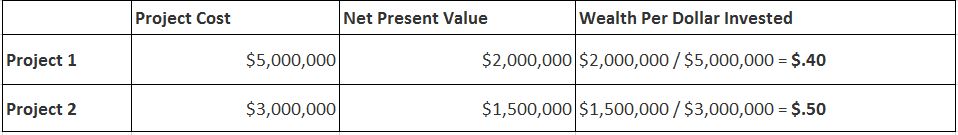

There are also other factors that you may need to look into to determine if it’s truly a good investment. For example, let’s say one project will cost $5 million and generates a net present value of $2 million and another project costs $3 million and generates a net present value of $1.5 million. You may think the first project is the better investment. But the second project actually generates more wealth per dollar invested:

In other words, for every dollar invested into the second project, it is projected to generate 50 cents of revenue per dollar invested. With the first project, every dollar invested is projected to generate 40 cents of revenue per dollar invested.

How Do Businesses Use Net Present Value?

Since net present value is a tool that helps you determine the value of an investment, it can be used in a variety of ways.

Whether you’re an owner of a restaurant looking to purchase a building to grow your business, or a construction company looking to purchase another business to expand, net present value can be used to help you make an informed decision.

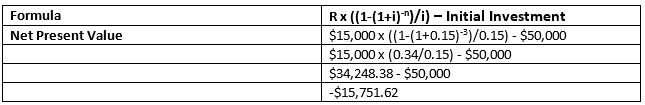

Say the owner of a landscaping company is looking into purchasing a piece of equipment that costs $50,000. The equipment is estimated to pull $15,000 into the company over the next three years. The discount rate is 15%. Because the projected cash flow is even for the next three years, the business owner would make sure to use the correct formula. Here’s what it looks like:

With a net present value of -$15,751.62, the piece of equipment may not represent a good investment because it could lose the business owner money over the three years. But, although the net present value is negative, the business owner should remember that the formula is based off of assumptions and that there are other factors that could determine whether it’s wise to make the investment.

What Are Alternatives to Net Present Value?

Another method of helping business owners determine if an investment is worth making is determining the internal rate of return, or IRR. This is the rate that will make the net present value 0—or it will tell you the expected rate of return on an investment.

When you figure out the internal rate of return, you can compare it to a minimum required return rate. If it’s higher than the minimum return rate, then you’re looking at a good investment.

So, say your minimum required return rate on a piece of equipment you want to invest in is 10%. After calculating the net present value, you find that the internal rate of return is 13%. Because the internal rate of return of 13% is higher than the 10% minimum return rate, you would likely consider making the investment.

Net Present Value and Discounted Cash Flow

When it comes to investing in a business, bond, stock, or a long-term asset, the net present value analysis subtracts the discounted cash flows from your initial investment. In simpler terms: discounted cash flow is a component of the net present value calculation.

The discounted cash flow analysis uses a certain rate to find the present value of projected cash flows of a project. You can use this analysis before purchasing a piece of equipment or asset to determine if the asking price is a good deal or not.

The net present value calculation subtracts the discounted cash flow value from the initial cost of investment. If the net present value is positive, it may be a good investment opportunity because it could provide you a return. If it’s negative, it may not be a good investment because the asset or project could lose you money.

This blog was… how do I say it? Relevant!! Finally I’ve found

something that helped me. Kudos!

Your insights are like a breath of fresh air! ️✨

Absolutely loved every word on this forum. Keep sharing your wisdom!