Key Takeaways

- Net Present Value (NPV) helps you determine if an investment will make more money than it costs you by comparing future cash flowers to today’s value.

- A positive NPV means the investment could bring a profit, while a negative NPV warns that you might lose money.

- Using NPV can help provide business owners with a simple way to compare projects and make smarter decisions about spending for growth initiatives.

As a small business owner, you may reach a point where you’re thinking about new equipment or assets to help grow your company. The challenge is knowing if the investment will bring a return.

That’s where net present value (NPV) helps. At its simplest, NPV looks at the future cash flow an asset is expected to generate and then discounts it to today’s value. After these discounted cash flows are added up, you subtract the initial investment, or cost of the asset. This calculation gives you the net profit value definition in action.

So, what does NPV stand for in finance? It means “net present value,” a method used to determine whether projected cash flows are worth more than the money you spend up front.

By showing you whether the value of future cash flows outweighs the initial cost, NPV gives you a practical way to evaluate potential investments and understand their long-term impact.

Benefits of Using NPV

Using net present value has several advantages that make it a practical tool for evaluating investments:

- Compare Projects: NPV makes it easier to weigh projects with different time frames and cash flow patterns by putting them on the same financial basis.

- Support Decision-Making: It provides a straightforward way to see if future returns are likely to outweigh costs, helping you make more informed choices about whether to move forward.

- Account for Time Value of Money: NPV incorporates the fact that a dollar today is worth more than a dollar in the future, giving you a more accurate picture than methods that don’t account for changing value over time.

NPV is a valuable tool that not only highlights whether an investment is likely to pay off, but also gives you a clearer, more reliable basis for comparing options and planning for long-term growth.

So how do you calculate NPV?

Calculating Net Present Worth: What Is the Net Present Value Formula?

There are two formulas to calculate the net present value—the formula you use depends on the type of cash flows. If the cash flows are the same each year, you use an annuity formula. If they vary, you discount each cash flow separately.

For equal yearly cash flows, apply the annuity formula:

R x ((1-(1+i)-n)/i) – Initial Investment

- The R represents the net cash flow for each time period.

- The i is the discount rate that will be used to find the present value of the future cash flows. The discount rate can also be thought of as the desired rate of return you could get on your investment.

- The n represents the time period you’re looking at to value the asset.

For varying yearly cash flows, the calculation changes. This is where people often ask, “What is the net present value method?” since it applies when cash flows differ over time. In that case, use this formula:

(C for Period 1 / (1+r)1) + (C for Period 2 / (1+r)2 + … C for given time period t / (1+r)t) – Initial Investment

- The C represents the cash flow for the given time period.

- The r represents the discount rate, or your desired rate of return.

- The t represents the time period.

In this formula, each projected cash flow is discounted to the present, added together and then reduced by the initial investment. The result is the net present value.

What Is a Net Present Value Example?

A common question that business owners ask is: What is NPV in finance and how does it look in practice? Here’s a simple example.

Imagine you’re evaluating a potential purchase. The equipment you’re considering costs $25,000, and over the next five years it’s estimated to generate an additional $6,000 a year. Those yearly projections are the same type of numbers you’d track in a cash flow statement. With a discount rate of 5%, is it worth the investment once you account for the initial price and other business expenses?

Because the projected cash flows are the same for each year, you would use the first formula. Here’s how it works:

1

Formula

R x ((1-(1+i)-n)/i) – Initial Investment

2

Input Information

$6,000 x ((1(1+0.05)-5)/0.05) – $25,000

3

Net Present Value (NPV)

$6,000 x ((1-(1.05)-5)/0.05) – $25,000 = $976.86

If the equipment is estimated to generate different cash flows for each year, you would use the second formula to find the net present value. Say the equipment is going to generate an additional $5,000 in the first year, $5,500 in the second year, $3,000 in the third year, $2,000 in the fourth year and $1,500 in the fifth year, the rest of the scenario—initial cost of investment and discount rate—remains the same.

| Cash Flow | Formula: (C for Period 1 / (1+r)1) + (C for Period 2 / (1+r)2 + … C for given time period t / (1+r)t) – Initial Investment | Total |

|---|---|---|

| Year 1 | $5,000 / (1+0.05)1 | = $4,761.90 |

| Year 2 | $5,500 / (1+0.05)2 | = $4,988.66 |

| Year 3 | $3,000 / (1+0.05)3 | = $2,591.51 |

| Year 4 | $2,000 / (1+0.05)4 | = $1,645.40 |

| Year 5 | $1,500 / (1+0.05)5 | = $1,175.29 |

| Net Present Value | ($4,761.90 + $4,988.66 + $2,591.51 + $1,645.40 + $1,175.29) – $25,000 | =-$9,837.24 |

Over the next five years, the equipment is estimated to generate $30,000. The present value of the $30,000 is about $25,976.86. This means the money the equipment is generating for your business over the next five years is worth more than the initial investment of $25,000—about $976.86 more. So, you may see a positive NPV and it suggests the investment may return slightly more than it costs. A higher NPV would indicate an even better return, while a lower positive value shows a thinner margin.

In this example, the equipment is expected to generate an additional $17,000 over the next five years. After discounting the projected cash flow, that money is worth about $15,162.76 in present time. This is $9.837.24 less than the $25,000 initial investment—represented by a negative NPV, showing discounted cash flows don’t cover the upfront cost. A negative NPV doesn’t always mean you shouldn’t invest, but it signals added risk that requires further NPV analysis.

Finding Net Present Value (NPV) Equation in Excel

The Excel spreadsheet software includes an NPV formula built into its NPV function. This allows you to quickly discount the projected cash flows and find the present value. Check out this video to follow along.

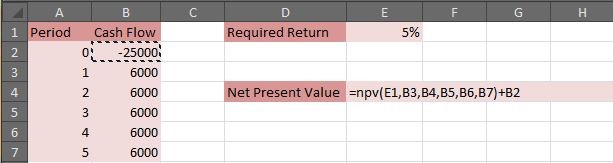

To find the net present value using Excel, you’ll need to set up your spreadsheet properly. Create a column for “Period” and put in 0 through the number of years you’re looking at. Label the next column “Cash Flow” and put in the corresponding numbers for each time period. For Year 0, you’ll put in the initial investment cost (represented by a negative number).

The net present value function is “=npv(rate, value 1, value 2, ….).” In a separate cell, start putting in the function. You can click on each cell as you fill in the formula or manually type in each cell number. When you press enter, you’ll find the present value of the projected cash flows. It’s important to note that Excel’s NPV() function assumes cash flows occur at the end of each period.

To find the net present value, you’ll have to go back into the Excel function. You can double-click the cell where you completed the function earlier. At the end of the function, put in an addition symbol and the cell number where your initial investment cost is. This tells Excel to find the present value of the cash flows and then add in the initial cost of the investment. Because it’s a negative number, the initial investment will be subtracted from the present value cash flows.

This approach ensures the NPV accounts for both your expected returns and your upfront costs.

This is what the net present value function looks like while you’re filling in the formula with data from the Excel sheet.

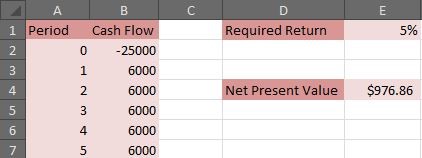

In this example, the projected cash flows were even throughout the five years. Using the function in Excel, the net present value is $976.86.

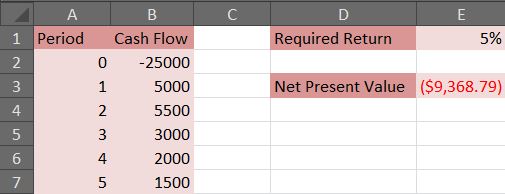

You can perform a similar calculation for the second example, where the cash flows are different for each year.

In this case, Excel calculates the net present value of -$9,837.23, which means the asset is likely to lose you money over the five years.

How To Interpret the Results

When you calculate NPV, the resulting number tells you whether the investment may be worthwhile. A positive result generally signals potential profitability, while a negative result points to possible losses. Let’s break down how to interpret each outcome.

What NPV Is Good?

A good NPV is a positive number, because it shows the investment is expected to generate more value than it costs. A negative NPV, by contrast, suggests the project may result in a loss.

Positive Net Present Value

When you calculate the net present value of an asset, you’ll get either a positive or negative number. It’s this number that will help you make a more informed decision on whether to invest in the asset.

A positive NPV suggests the investment could return more than it costs. It shows you that while you are losing money up front (for the initial investment), the asset is going to generate cash flows in the future that, in total, are worth more than the initial cost. It’s important to remember that there are limitations with the net present value (NPV) calculation. Since it’s based on assumptions of projected cash flow, the calculation is only as good as the data you put into it.

If your NPV calculation results in a positive net present value, this could be a good investment opportunity.

Negative Net Present Value

If your NPV calculation results in a negative net present value, this means the money generated in the future isn’t worth more than the initial investment cost.

A negative net present value means this may not be a great investment opportunity because you might not make a return. Essentially, a negative net present value is telling you that, based on the projected cash flows, the asset may cause you to lose money. There are other factors outside of the net present value calculation that could still make this a potentially good investment, such as providing enhanced safety or increasing company morale.

Zero Net Present Value

If your NPV calculation results in a value of zero, it means the project is expected to break even, meaning the present value of future cash flows is exactly equal to the initial investment cost. While this doesn’t suggest a loss, it also doesn’t indicate a profit—it simply means the project is projected to generate just enough value to cover its costs. A zero NPV can still be acceptable in some cases if the investment provides strategic, non-financial benefits or aligns with broader business goals.

Present Value and Net Present Value (NPV)

Money today is more valuable than the same amount in the future, so you need to calculate what projected cash flows are worth right now. This calculation, called present value, discounts each year’s cash flow by a set rate.

Net present cash flow is the total of all discounted cash flows. Subtract the initial investment from that total to get the net present value, which shows if the asset is likely to generate a gain or a loss.

Net Present Value: A Tool That Helps You Make an Investment Decision

Buying equipment, office space or any long-term asset is a major expense, often reaching tens or hundreds of thousands of dollars. An NPV calculation helps you decide if that investment is likely to pay off.

The process is straightforward: project the future cash flows, discount them to today’s value, and subtract the initial cost. A positive net present value signals a potential gain. A negative one warns that you may lose money.

Net Present Value FAQs

What Is a Net Present Value (NPV)?

At its simplest, NPV looks at the future cash flow an asset is expected to generate and then discounts it to today’s value. After these discounted cash flows are added up, you subtract the initial investment, or cost of the asset. This calculation gives you the net profit value definition in action.

What NPV Is Good?

A good NPV is a positive number, because it shows the investment is expected to generate more value than it costs.

Very informative.