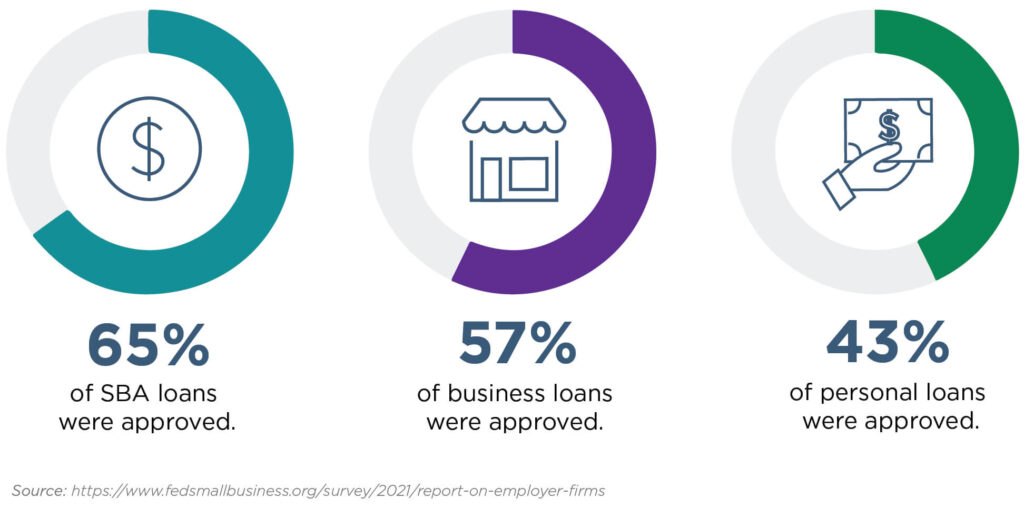

With a variety of loan options in amounts ranging from $500 to $5.5 million, a U.S. Small Business Administration (SBA) loan can be an attractive option for small business owners seeking funds. Plus, SBA loan approval rates are relatively high compared to other options: In 2021, SBA loans had an approval rate of 65%, compared to a 57% approval rate for business loans and 43% for personal loans.

But choosing an SBA loan can seem complicated at first. The SBA offers three types of loans, and each loan program has its own requirements and restrictions.

In this article, we’ll guide you through the different types of SBA loans to help you select the right loan for your small business.

What Are SBA Loans?

SBA-backed loans are commonly referred to as SBA loans. This can cause some confusion about who provides the loans: The SBA partially guarantees SBA loans, but you have to apply through an approved third-party lender to get one. The only loans the SBA provides directly are disaster relief loans for homeowners and businesses.

Eligibility Criteria

To apply for an SBA loan, you’ll need to meet three different sets of eligibility criteria:

General SBA eligibility requirements. These include the following:

- Your business must be a for-profit business operating in the U.S. or its territories.

- You need to have a reasonable amount of your own money invested in the business.

- You’ve already turned to alternative sources of financing (including your personal assets).

Lender-specific eligibility requirements. These requirements vary from lender to lender, but individual lenders will generally assess your eligibility based on the following:

- Business-related information, including how long you’ve been in business, your business plan, and recent financial statements.

- Information about any collateral you might be able to provide.

- Both your personal credit score and your business’s credit score.

SBA-loan-specific eligibility requirements. Finally, each type of SBA loan has its own set of eligibility requirements, which we’ll cover below.

SBA 7(a) Loans

The SBA’s 7(a) loan program is the most popular of its three loan options. In 2021, lenders provided small businesses with more than $36.5 billion in funding through the SBA’s 7(a) loans, compared to $8.2 billion for 504/CDC loans and $71.8 million through the microloan program.

Rules for Using SBA 7(a) Loans

You can use your 7(a) loan proceeds for many different purposes, including working capital, business debt refinancing, and the purchase of real estate and other fixed assets, such as equipment and machinery. For example, you could use your 7(a) loan to refinance existing debt so your interest rates or your monthly payments are lower. But there are also certain restrictions on your use of 7(a) funds (including specific conditions under which loan proceeds can’t be used to refinance debt).

Types of SBA 7(a) Loans

You have several loan options under the umbrella of the SBA’s 7(a) loan program. In all but one loan program—the Export Working Capital loan—you’ll negotiate your interest rate with the lender, but this rate is subject to a cap. For certain loan options, lenders in the Preferred Lenders Program (PLP) may have more authority to process and service SBA loans (which typically means a faster loan processing time).

Standard 7(a) loan. With the standard 7(a) loan, you can borrow up to a maximum of $5 million. While the SBA determines eligibility and makes credit decisions, it can also grant PLP lenders the authority to make these decisions, too.

7(a) Small Loan: The maximum 7(a) small loan amount is $350,000. Like the standard 7(a) loan, PLP lenders may have the authority to determine your eligibility and make credit decisions.

SBA Express. The Express loan program offers a speedier process, with a 36-hour turnaround time. You can obtain funds of up to $500,000, and eligibility and credit decisions are up to the lender.

Export Express. For export businesses, response time for the Export Express program is 24 hours, and you can apply for a maximum loan amount of $500,000. Like the SBA Express program, the lender makes all eligibility and credit decisions.

Export Working Capital. The Export Working Capital loan program offers a maximum loan amount of $5 million for export businesses. While the SBA may authorize PLP lenders to make eligibility decisions, the agency retains decision-making power over credit decisions. Unlike the other 7(a) loans, there is no cap on the interest rate you negotiate with the lender.

International Trade Loans. You can obtain up to a maximum loan amount of $5 million under the International Trade loan program. The SBA determines eligibility and makes credit decisions. You can use loan proceeds to purchase fixed assets and help meet working capital requirements for export transactions.

CAPLines. The CAPLines program offers four different working capital lines of credit:

- Seasonal CAPline, for financing seasonal accounts receivable, inventory, or, in some cases, labor cost increases.

- Contract CAPLine, for financing the direct labor and material costs of assignable contracts.

- Builders CAPLine, for financing construction or renovation direct labor and material costs of small general contractors or builders.

- Working CAPLine, for financing cyclical growth and recurring or short-term needs.

Key Details About SBA 7(a) Loans

Eligibility requirements. To be eligible for a 7(a) loan, you’ll need to:

- Meet the SBA’s definition of a small business.

- Demonstrate your need for the 7(a) loan.

- Use the loan proceeds for a sound business purpose.

- Not be delinquent on any federal government debt obligations.

Additionally, certain types of businesses are not eligible for 7(a) loans, including:

Repayment terms. Loan maturity for 7(a) loans depends on factors including your ability to repay the loan, how you’re using the loan and the useful life of any assets purchased with loan proceeds. Maximum terms range from 10 years for working capital, inventory or equipment loans to 25 years for real estate. Prepayment penalties may also apply for loan maturities of 15 years or longer.

Interest rates. With the exception of the Export Working Capital loan, all 7(a) loans are subject to a maximum interest rate. Fixed rates are pegged to the prime rate, while variable rates can be based on either the prime rate, the LIBOR rate or an optional peg rate.

SBA 504/CDC loans

The SBA 504/CDC loan may be a good option if you need long-term financing at a fixed rate to purchase fixed assets. You can obtain these loans through non-profit Certified Development Companies (CDCs).

Funding for your fixed-asset purchase comes from three sources: the CDC, a third-party lender and your down payment. The maximum loan amount for the SBA/CDC portion is $5 million (and up to $16.5 million for certain types of energy projects).

Rules for Using SBA 504/CDC Loans

There are more restrictions on your use of your 504/CDC loan proceeds, since the purpose of these loans is to fund the purchase, construction or improvement of major fixed assets. For example, you can use a 504/CDC loan to renovate existing property for the purpose of expanding your business. You can’t, however, use loan proceeds for working capital or inventory needs, debt repayment or refinancing, or investments in rental real estate.

Key Details About SBA 504/CDC Loans

Eligibility requirements. In addition to meeting the general SBA eligibility requirements, 504/CDC eligibility includes factors such as your business’s net worth and your repayment ability. Your business also must be within the SBA size guidelines. Additionally, certain businesses, such as non-profit businesses and those that engage in passive or speculative activities, are ineligible.

Repayment terms. Repayment terms vary depending on a number of factors, but 10- and 20-year loan maturity terms are available.

Interest rates. 504/CDC loans offer a fixed rate of interest that’s pegged to current market rates for U.S. Treasury issues.

SBA Microloans

The SBA offers its microloan program through SBA-approved nonprofit community-based organizations. These intermediary lenders make the credit decisions and set the terms for each microloan.

The maximum microloan amount is $50,000, and the average loan is $13,000. In 2021, the microloan program provided funding to close to 4,400 businesses, with 41% of loans going to communities traditionally underserved by the banking industry.

Rules for Using SBA Microloans

You can use a microloan for several different business purposes, such as inventory costs, equipment upgrades and working capital. For example, you can use your microloan proceeds to fund the purchase of products for resale. You can’t, however, use microloan proceeds to buy real estate or pay off your business debts.

Key Details About SBA Microloans

Eligibility requirements. While every microloan intermediary lender has its own eligibility criteria, many will require collateral as well as your personal guarantee.

Repayment terms. Repayment terms will factor in your intended use of the funds, the lender’s requirements and your business needs. The maximum term can’t exceed six years.

Interest rates. The interest rate for your microloan will vary depending on the intermediary lender, but according to the SBA, the rate will usually be between 8% and 13%.

How To Apply for an SBA Loan

Interested in applying for an SBA loan? Here are the steps to follow:

- Decide what type of SBA loan you want to apply for.

- Find lenders that offer the SBA loan you want through the SBA’s Lender Match tool.

- Compare the terms and eligibility requirements offered by local lenders.

- Apply directly through your selected lender.

If your small business is in need of funds, it makes sense to explore the loan options offered by the SBA. With the variety of loan programs available and competitive interest rates, an SBA loan could help you get out of a cash crunch and reach your business goals.

Next Steps: Sign up for the Small Biz Ahead newsletter to learn more finance tips and tools to help your small business succeed.

I would like to learn more about SBA loans.

Hi Michael, thanks for reaching out! You can learn more about SBA loans here:

https://sba.thehartford.com/media/podcasts/sba-loans/

https://sba.thehartford.com/media/podcasts/financing-in-2023/