One of the first challenges you face as an entrepreneur is determining how to finance your new business. If you choose self-funding, taking out an SBA loan or obtaining a line of credit, you can maintain full control and ownership of your business—or you can opt to invite outside investors.

While self-funding, loans and credit offer more autonomy, they also require you to shoulder the full financial burden. Turning to investors can be a good option, but you’ll need to consider additional factors when deciding whether it’s the right way to finance your small business.

3 Common Types of Business Investors

Before we dive into the pros and cons of using business investors to fund your startup, let’s cover some common types of investors small business owners use.

Friends and Family

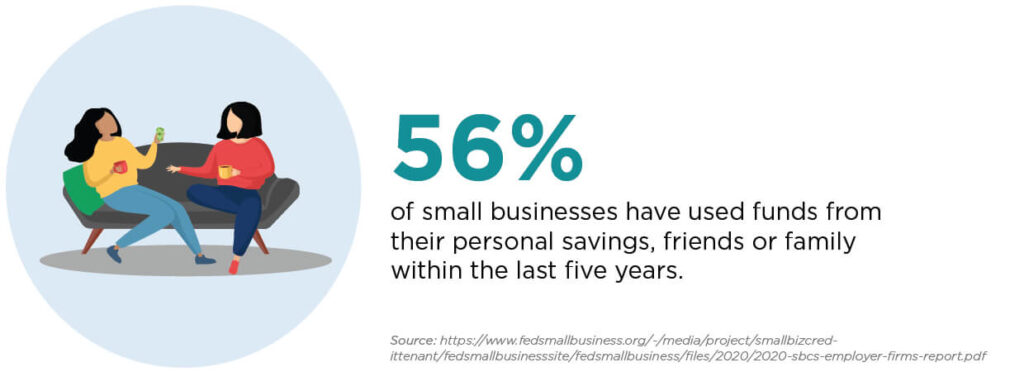

This is sometimes referred to as “personal investors.” While the name is self-explanatory, accepting seed money for your new business from family and friends isn’t as simple as it sounds. That’s because most people in your personal circle likely aren’t “accredited investors”—a term created in wake of the Great Depression to protect people from investment scams.

Accredited investors must show that their income and personal wealth would help them weather the financial storm of failed investments. Beyond those limitations, business owners with personal investors also face the risk of straining close relationships if their businesses struggle.

If you decide to use investments from personal investors, carefully document their contributions and consider working with a lawyer. A lawyer can clarify any questions and ensure everyone is on the same page. You may also want to ask your investors to sign an acknowledgement of their risk, including recognition that they may not get their money back.

Despite the challenges, many small business owners accept personal investments from family and friends, especially during the early phase of their business when other options seem scarce.

Angel Investors

Like personal investors, angel investors invest their own money. Unlike personal investors, they are accredited by the SEC. So there aren’t strict legal limitations on how much they can invest in your business or restrictions on how they can support your business. These investors often started as entrepreneurs and then went on to invest in startups in their own industry, especially those that may have trouble securing traditional financing.

Angel investments can come in the form of a loan or a stock purchase, which gives them equity in your small business. Some angel investors act as advisors, sharing their time and expertise. Sometimes, angel investors join together in groups to pool their money and make larger investments with access to an expanded network.

Venture Capitalists

Venture capital (VC) firms invest other people’s money—usually from large enterprises, institutions and extremely wealthy individuals. Each of their investments can reach into the millions, so they tend to require a thorough vetting period prior to making an investment.

VCs are also more hands-on in managing the companies they invest in, often serving as members of their boards of directors.

Ultimately, venture capitalists are after one thing: high ROI. For this reason, VCs typically come into play later in a small business owner’s journey, when the company already has a track record of success and a growth trajectory.

The Pros of Using Investors to Finance Your Business

Engaging investors in your business can offer several benefits. Your business may grow more quickly thanks to access to funds, valuable connections and additional expertise you may receive from investors. You may also reduce your own financial risk.

Cash flow. The most obvious advantage of engaging investors: Money. Not only are they helping finance your business now, but they may continue to be a source of cash for future needs. An investor wants your business to succeed, so they’re more likely to help you with additional funding down the road.

Connections and expertise. Working with investors can expand your professional network. Beyond funding your business, your investor may also bring connections and experience that you don’t have yet—especially if you’re working with an angel investor who has a track record in your industry. Their knowledge can help you make smart business decisions without learning those lessons the hard way. Investors can also make valuable introductions to pave a smoother path to success.

Faster growth. With an investor’s expertise, network and access to cash, your business may grow more quickly. Their connections could bring you more (and larger) customers. They may also connect you with vendors that improve your operations and other valuable business partners. An investor’s know-how can help you navigate tough times and keep growth on track.

Lower personal risk. You don’t want a failed business to ruin your personal finances, especially if you have a family. Working with investors means you put less of your own money on the line.

The Cons of Using Investors to Finance Your Business

While investors can offer business-boosting benefits, some small business owners know the cons all too well. Here are some potential disadvantages to consider before deciding to seek funding from investors for your small business.

Less control. Chances are, investors will want a say in how you run your business—especially if they’re a VC or an angel investor. While their ideas can be helpful, they may also go against the long-term vision you have for your business. Short-term success often guides investors, but you may take a more future-focused view. At times, those differing goals can clash. But shareholders are legally entitled to meet with you and, depending on your agreement, they may retain rights to vote on business matters. Once you’ve accepted an investor’s money, you also relinquish your role as sole decision-maker for your business.

Added pressure. Even if your investors are happy to be hands-off when it comes to your business, you may feel more pressure to turn a higher profit and grow quickly. Most investors expect regular updates and financial reports on sales, expenses, profits, overall performance and explanations of management decisions. If you’re uncomfortable with the idea of reporting to others and sharing regular updates, taking on investors may not be the right decision for you.

Less profit. Investors expect a return on their money—unless, of course, your Great Aunt Sally simply wanted to help you follow your dreams. This means you’ll either need to pay them back over time or that they’ll earn a return another way, likely through an equity deal. And when you release a percentage of ownership, you’re left with a smaller share of the profits. If you don’t give up equity, then you’re likely paying interest on a loan or paying out dividends to your investors. which can slow business growth and reduce your personal income.

Are Investors Right For Your Business?

It’s up to you whether taking on investors to finance your business is the right move. Consider how the pros and cons fit into your goals as a business owner.

For instance, do you see yourself running this business for life or selling it in five years to make a profit and move on? Are you hoping to simply support your family or to grow a large enterprise and become a wealthy investor yourself?

As you move further into your business ownership journey, your goals may evolve. So, whatever path you follow for now, keep in mind that you may change your mind as you and your business evolve.

Next Steps: Want to learn more? Sign up for the Small Biz Ahead newsletter to receive a weekly roundup of the latest tools, trends, and resources.

Hey There. I discovered your blog the use of msn. This

is a very neatly written article. I will be sure to bookmark it and come back to learn extra of your useful information. Thanks

for the post. I’ll certainly comeback.

It is a very good advice.

We’re glad you found it helpful. Thanks for commenting, Ally!

It is truly a nice and useful piece of information. I’m happy that you

shared this helpful information with us. Please stay us up to

date like this. Thanks for sharing.

You’re welcome!

This is such an important post! I went through the whole post and I came to know about investment.

This is one of the best newsletters I’ve ever read.

That’s great to hear, Robert! Thanks for commenting!

Do you have recommendations on resources, links, ways to find possible investors in any of the categories above?

Hi Kirk, thank you for reaching out! You can find more information at the links below:

Angel investors – https://sba.thehartford.com/home/angel-investors/

Friends + Family – https://sba.thehartford.com/media/podcasts/financing-from-friends-and-family/

Venture capitalists – https://www.thehartford.com/business-insurance/strategy/business-financing/venture-capital

This statement is not accurate:

“Accredited investors must register with the Securities Exchange Commission (SEC).”

Some of the other statements about being an accredited investor are also not accurate. Investors self-certify that they meet one or more of the requirements to be an accredited investor. The investor does not have to register with the SEC.

We just updated the content, Joe. Thank you!