The Covid-19 crisis will undoubtedly cause small businesses to seek external funding in the United States. Whether through government grants, loans from traditional banking institutions or alternative funding sources, thousands of small business owners throughout the country will need financial assistance to overcome the economic impact of this epidemic.

But how often were small businesses in America using external funding to start, manage or expand their businesses before the Coronavirus pandemic? In the first quarter of this year, Small Biz Ahead surveyed small business owners across the country, aiming to learn more about how entrepreneurs use both traditional and alternative forms of business funding.

The Majority of U.S. Small Business Owners Are Hesitant to Use External Funding

Before the appearance of Covid-19, most small businesses were hesitant to use any form of external funding, particularly when it meant starting a new venture. Our survey found that:

Even in areas where funding from the government is available, surprisingly few people choose to use them. In fact, we found less than 1% of all small businesses in America used a federal or state grant to start their business.

But what about businesses that are already established? Prior to the Coronavirus epidemic, we found that small business owners are still hesitant:

Where businesses are seeking support with funding, most are avoiding alternative funding sources and instead opting for more traditional options, or even personal financing. We found nearly 28% of small business owners have used their credit cards to finance parts of their business in the past. Working capital and cashflow are the main reasons businesses borrow money, accounting for half of all small business finance.

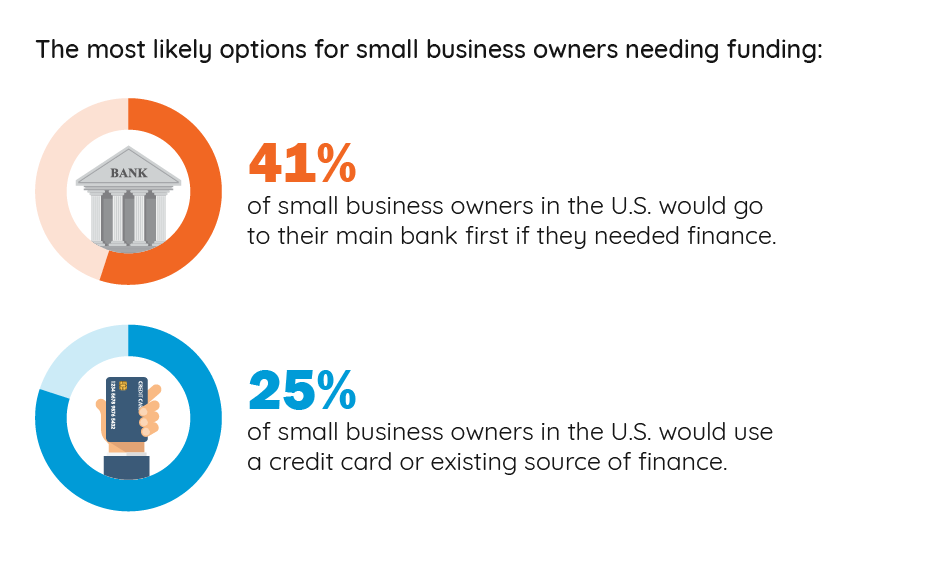

Where businesses are applying for finance, they are likely to opt for traditional, existing providers:

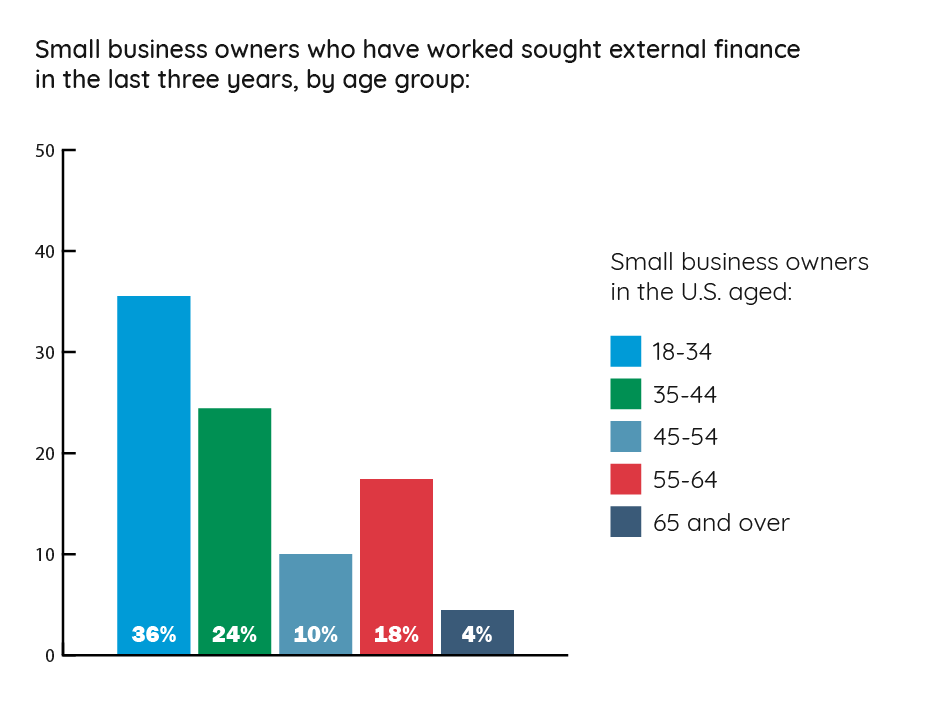

Younger Generations More Likely to Apply for Finance or Ask for A Loan

Despite an overall hesitance to turn to external financing, our research highlighted a clear generational gap, with younger generations far more likely to look for external funding for their small businesses:

As well as being more open to seeking external finance, we found that younger generations are far more likely to use a loan from friends or family to start a small business. Our research found nearly a third of small business owners aged 18-34 currently use this as a source of finance. This drops sharply for older generations, with just over 10% of 35-44 year olds and less than 2% of 45-54 year olds saying they use loans from friends and family.

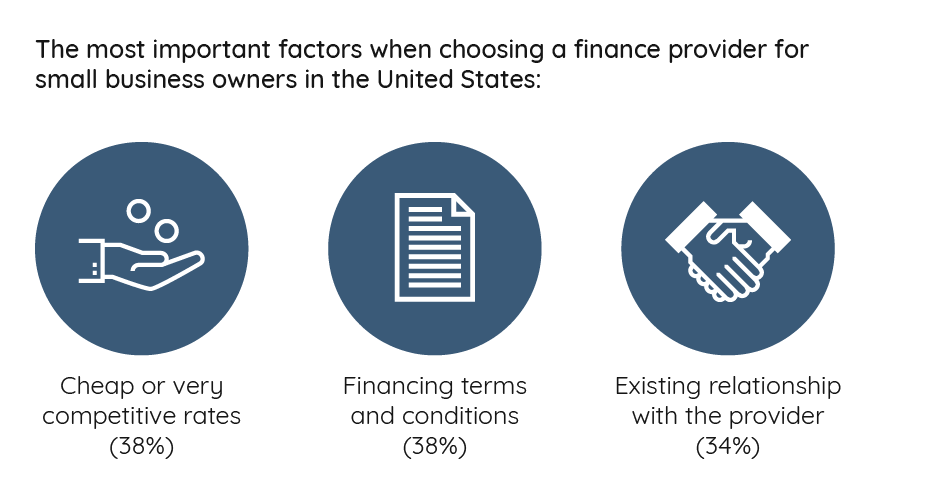

Demographic Splits in Factors When Choosing Providers

Where small businesses are seeking external finance, there were clear preferences in what they look for from potential providers:

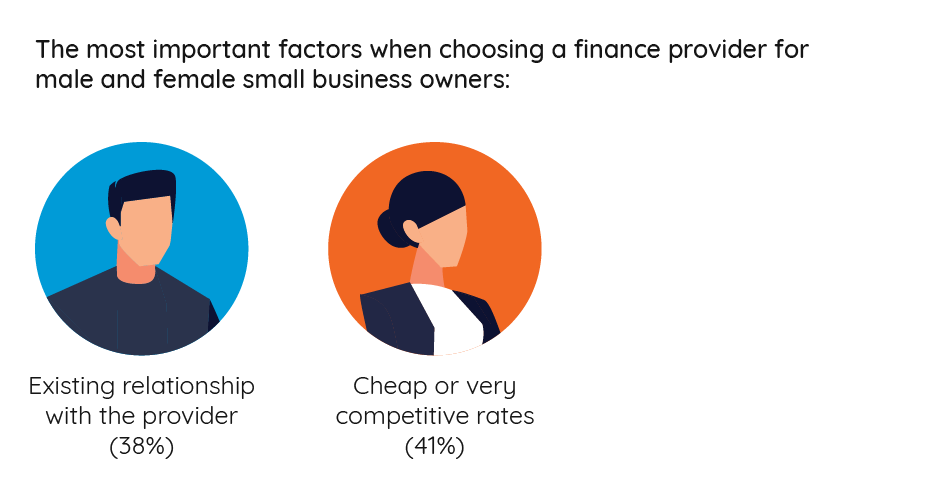

However, there are differences in these preferences when we dive down into the demographics. Between genders, men are more likely to view an existing relationship as the most important factor, whereas women would look for cheap or competitive rates:

There is also a clear divide between age groups. For younger generations, ease of application was the most important factor when applying for small business finance, but this changes among older generations. For those aged 35-64, cheap or competitive rates was the most important factor. For those 65 and over, it was an existing relationship with the provider.

Younger Generations More Likely to Use Alternative Funding Sources

Alternative finance is still not widely used by small business owners in the U.S. according to our research. For example, we found that only 3.2% of small businesses have used equity finance, while just 2.4% have used P2P (peer-to-peer) lending. However, small business owners remain open to the possibility of using alternative finance in the future:

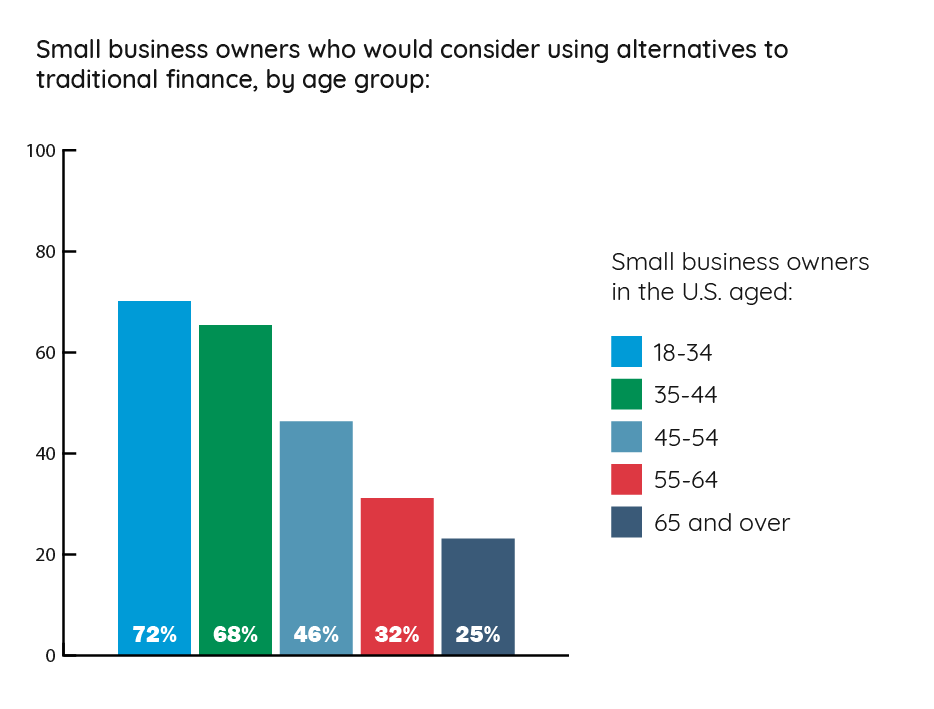

As you might expect, younger generations are far more likely to use alternative finance options. More than 10% of small business owners aged 18-34 have used P2P lending, while just over 5% have used crowdfunding to raise money. When asked if they would consider using alternatives to traditional finance in the future, younger generations were far more likely to say yes:

We also found a clear gender gap when it comes to alternative forms of finance. Our research found that men are nearly five times as likely to use equity finance, and nearly three times as likely to use venture capitalists.

Next Steps: Want to learn more? Sign up for the Small Biz Ahead newsletter to receive a weekly roundup of the latest tools, trends, and resources.